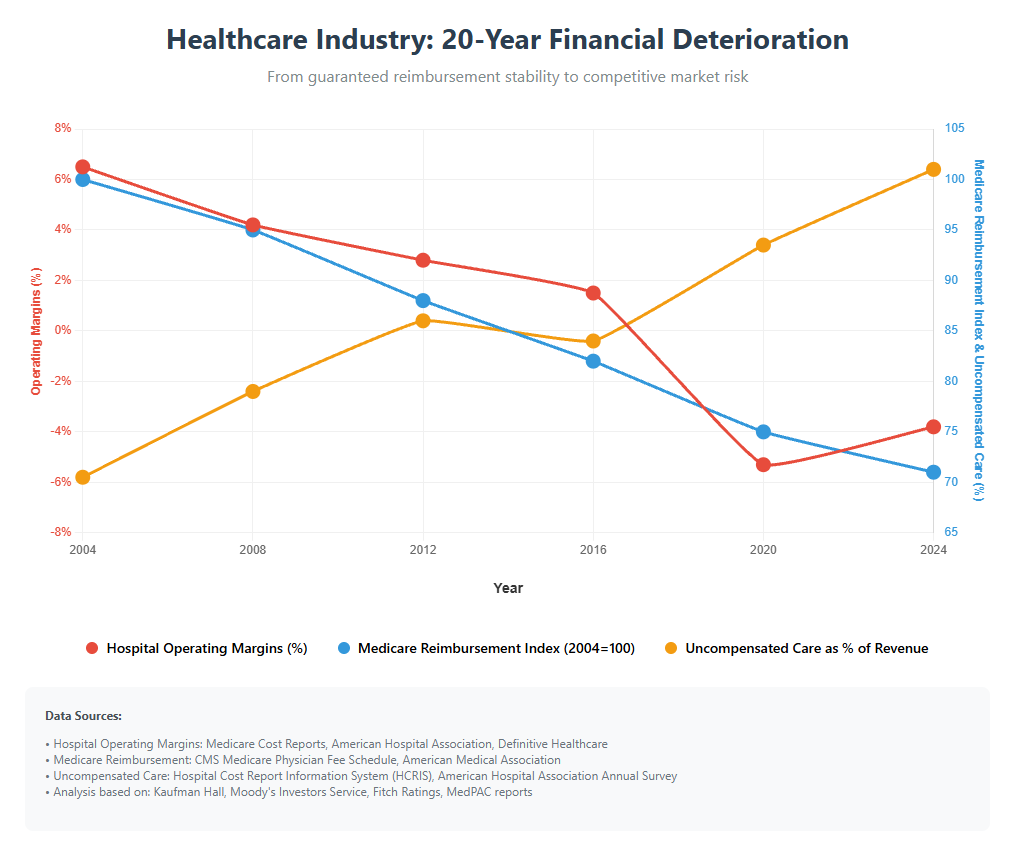

A fundamental truth about American healthcare is that it has traditionally operated as a non-competitive market. Unlike other businesses, where competition drives innovation, efficiency, and customer value, healthcare organizations have been largely insulated from most market forces.

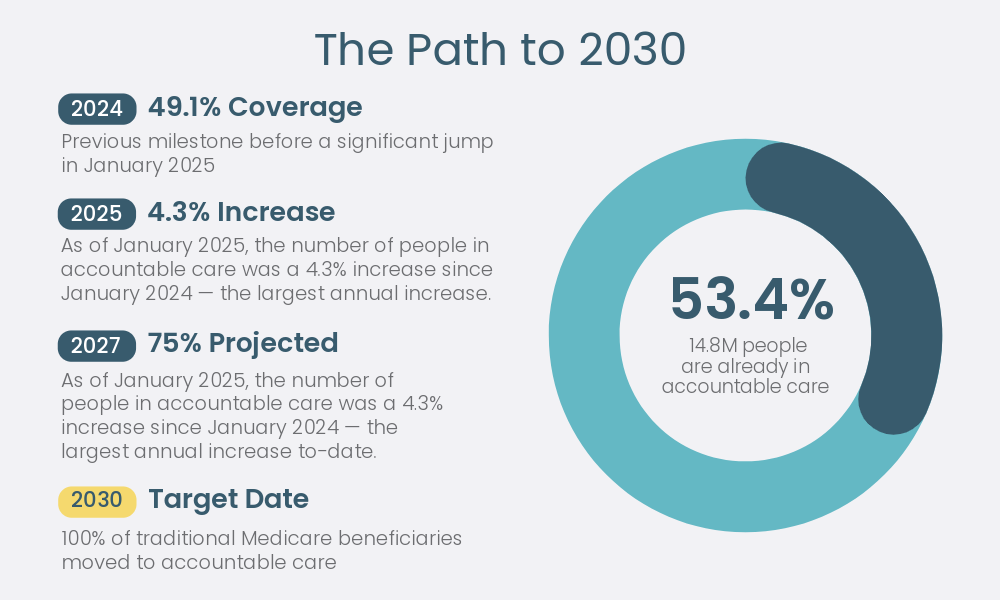

But this bubble is rapidly dissolving. Healthcare now faces competitive pressures as the market turns from fee-for-service payment systems to value-based care (VBC) models. A driving force behind this transformation is the Centers for Medicare & Medicaid Services (CMS) looming deadline for reaching its accountable care goals.

By 2030, CMS wants all people who had traditional Medicare (fee-for-service) to instead be in “an accountable care relationship with a provider.” This volume of patients could have a seismic effect on the healthcare market.

Source: cms.gov Newsroom

For healthcare organizations, this competitive shift isn’t just academically interesting—it’s existentially important. The CMS may refer to it as an initiative, but healthcare organizations see it as a mandate.

We explore this topic with internist and public health physician Dr. Terry Sullivan to better understand how VBC introduces competition into healthcare, what can be learned from other competitive models, and how organizations can position themselves for success in this new landscape.

Dr. Sullivan is an internist and public health physician. He serves as a consultant for Neteera, with previous experience as the chair of the Colorado Board of Health and regional CMO for multiple managed care organizations, including Humana.

Dr. Sullivan is an internist and public health physician. He serves as a consultant for Neteera, with previous experience as the chair of the Colorado Board of Health and regional CMO for multiple managed care organizations, including Humana.

Healthcare’s Non-Competitive Legacy

Healthcare’s unusual economic history helps explain how it has arrived at this turning point.

Unlimited payment systems: “It’s an open-ended system,” Sullivan explains, “and that can mean a highly inefficient system.” Unlike most industries, where costs are constrained by what customers are willing to pay, healthcare has primarily operated on revenue from insurance and government programs.

Disconnection between payer and recipient: The person receiving services typically doesn’t pay directly for them. Instead, Medicare and private insurance pay those fees. The unusual market dynamics where normal price sensitivity doesn’t apply.

Regional monopolies: Many markets have a dominant hospital system that faces little competition.

Regulatory protections: Some states use Certificate of Need (CON) laws to require state approval before healthcare providers can expand service areas or diversify services. This often limits new entrants into the market.

Economic incentives for expansion: “The Medicare program is run like a business with 435 people on the board of directors. That board is the U.S. Congress,” Sullivan notes, highlighting how political considerations around jobs and regional economic impact have shaped healthcare policy.

This system can protect inefficient providers from negative consequences and limit the advantages that efficient providers gain from operational excellence.

How Value-Based Care Creates Competition

Value-based care fundamentally changes healthcare economics in ways that introduce competition:

1. Fixed budgets replace open-ended reimbursement

“Value-based care is a system of care within economic constraints,” Sullivan explains. “Where things are being continually measured and improved.”

Unlike fee-for-service models, where more services always generate more revenue, value-based care provides fixed budgets to care for defined populations. This creates a competitive advantage for organizations that can:

- Deliver required services more efficiently

- Prevent expensive complications and hospitalizations

- Achieve better outcomes with fewer resources

- Manage chronic conditions more effectively

2. Quality metrics create performance transparency

Value-based models typically include quality metrics to compare providers. This transparency creates competition around:

- Patient outcomes and clinical quality

- Patient experience measures

- Preventive care completion rates

- Chronic disease management effectiveness

Metrics affecting payment and publicly reported can spur organizations facing competitive pressure to improve in underperforming areas.

3. Risk-bearing arrangements reward innovation

Tying financial risk to patient outcomes can incentivize improvement in care delivery.

“What we see happening today with our customers who want to address the financial risk is that the doctors, the outpatient people, are saying, ‘What does this mean?’ It means keep patients out of the hospital, keep them out of the ER,” according to Sullivan.

Achieving competitive differentiation can include:

- Novel care delivery models

- Preventive intervention programs

- Remote monitoring solutions

- Data-driven care coordination

Learning From Existing Competitive Models

While American healthcare is still in the early stages of competitive transformation, existing models that embrace competition can provide valuable insights into what works.

An integrated approach

Sullivan feels that “many medical school graduates in California want to work at Kaiser Permanente” because of the quality of the Kaiser system.

Among the aspects that can make Kaiser Permanente attractive to graduates is its vertically integrated model, combining insurance with care delivery to create:

- Financial incentives aligned with prevention and appropriate care

- Coordinated services across the care continuum

- Technology-enabled efficiency and quality improvements

- Measurement-driven continuous improvement

This approach can provide a competitive advantage that may allow Kaiser to attract top talent and grow its market share.

Medicare Advantage’s managed care success

Medicare Advantage plans operate under a fixed, risk-adjusted structure.

“If you look at companies like UnitedHealthcare, the reason they make money and are ahead of regular Medicare is that their hospital admission rate is lower than Medicare,” according to Sullivan. Specific provider admission rate data isn’t available, but studies support the fact that there are fewer hospital stays for Medicare Advantage participants overall, compared to traditional Medicare.

Creating a competitive advantage through reduced hospitalization could come through:

- Proactive outreach to high-risk members

- Care coordination programs

- Home-based care alternatives

- Robust disease management approaches

Regional medical and physician groups taking risk

In markets like Florida, Dr. Sullivan notes that physician groups are increasingly assuming the full financial risk for patient populations. “When possible, the risk is given to the doctors and medical groups.”

These physician-led organizations compete based on their ability to:

- Manage care efficiently

- Prevent unnecessary utilization

- Deliver high-quality outpatient care

- Coordinate effectively with specialists and facilities

Strategic Positioning for Value-Based Competition

As healthcare transitions to value-based competition, organizations face strategic choices about how to position themselves:

1. Efficiency-focused strategies

Some organizations will compete primarily on their ability to deliver the required services at lower costs.

This approach requires:

- Process streamlining and standardization

- Technology-enabled automation

- Appropriate staff deployment

- Elimination of unnecessary variation

2. Quality-differentiation strategies

Other organizations will compete by demonstrating superior clinical outcomes, focusing on:

- Evidence-based protocol implementation

- Enhanced care coordination

- Specialized expertise in managing complex conditions

- Superior preventive care performance

3. Experience-centered strategies

A third competitive approach focuses on superior patient experiences through:

- Convenient access points (virtual, home-based, etc.)

- Personalized care approaches

- Enhanced communication systems

- Frictionless administrative processes

4. Population-specific strategies

Some organizations will focus on competitive advantages in serving specific populations:

- Chronic condition management (diabetes, heart failure, etc.)

- Age-related specialization (pediatrics, geriatrics)

- Socioeconomic approaches (Medicaid expertise, dual-eligible specialization)

- Regional or cultural specialization

Sullivan emphasizes the role of technology in each strategy. According to Sullivan, providers should be asking, “What technology can be used to assist my people, improve efficiency, provide a better patient experience, and so on?” New medical technology solutions leveraging automation and AI enter the market nearly every day. Organizations embracing clinical technology, rather than resisting it, will be faster out of the gate in a competitive environment.

Structural Changes for Competitive Success

Beyond strategic positioning, organizations need structural capabilities to compete effectively in value-based models:

Technology infrastructure

No technology is ever better than its IT foundation. Without the correct hardware, software, networking components, integration, and support, medtech adoption will stall or fail. The IT team needs to be active in these conversations:

- Understand the type and volume of data involved

- Establish communication and connectivity protocols

- Apply the correct security protection at every ingress/egress point

- Know what is and isn’t possible for integration, and what it will take to make it happen

Data analytics capabilities

Competitive success in value-based care requires robust data capabilities to:

- Measure, track, and qualify based on the key performance indicators for the project

- Predictive or trending data that can support proactive care

- Statistics or metrics that aid evidence-based decision-making

- Include automated or AI-powered processes that relieve manual tasks

Organizations that can translate data into operational improvements gain significant competitive advantages.

Workforce flexibility

Value-based competition requires workforce models that can adapt to changing needs:

- Team-based care approaches

- Cross-training for expanded roles

- Virtual and in-person care capabilities

- Field-based care delivery

Approximately 15% of healthcare costs are attributable to salaries for doctors and registered nurses. Overall labor costs are likely higher when other levels of healthcare workers are included.

Managing workforce efficiency is crucial to keeping those costs down. Staff turnover also affects labor costs, and helping frontline workers avoid burnout can lower the impact.

Financial structures

Organizations need financial structures aligned with value-based competition:

- Capital allocation processes that prioritize long-term value creation

- Compensation models that reward value over volume

- Investment approaches for population health infrastructure

- Risk management capabilities

Preparing for Increased Competition

As healthcare competition intensifies, organizations should consider these preparation steps:

1. Honest competitive assessment

Start with a clear-eyed evaluation of:

- Current cost structures compared to market competitors

- Quality performance on key measures

- Patient experience ratings and trends

- Technological capabilities and limitations

2. Strategic capability building

Based on the competitive assessment, invest in capabilities that address weaknesses or enhance differentiation:

- Technology infrastructure

- Care model redesign

- Analytics capabilities

- Workforce development

3. Selective risk assumption

Rather than taking on full risk immediately, organizations may benefit from:

- Starting with specific patient populations where you have strength

- Focusing on particular conditions or care episodes

- Building risk capability gradually through shared savings models

- Creating risk-bearing entity structures with appropriate protection

4. Partnership development

Few organizations have all the capabilities needed to compete in the value-based care arena. Aligning with strategic partners can help.

Consider partnerships for:

- Technology infrastructure

- Specialized care management

- Risk management expertise

- Home-based care delivery

The Competitive Future Has Already Begun

While 2030 represents a marker for Medicare’s value-based transition, the competitive transformation is already well underway:

“We’re already at 54% of Medicare beneficiaries enrolled in Medicare Advantage. That number goes up when beneficiaries covered by an ACO are included,” says Sullivan.

Organizations that delay competitive positioning risk finding themselves unable to catch up as more efficient competitors establish market advantages. The transition period itself presents both the greatest risk and the greatest opportunity:

- Early movers can establish reputational advantages with patients and referral sources

- Operational efficiencies created now compound over time

- Data accumulated during the transition provides deeper competitive insights

- Workforce culture adapted to value-based care is increasingly difficult to replicate

Value-Based Care Changes Everything

Healthcare’s transformation from a non-competitive to a competitive industry is one of the most significant economic shifts in American business history. Guaranteed revenue streams and accepted inefficiency don’t have a place in the fundamentally different landscape under value-based care.

This transformation won’t happen overnight, and it won’t affect all market segments simultaneously. However, the direction is clear and accelerating. By 2030, healthcare organizations will operate in a genuinely competitive environment where efficiency, quality, and patient experience directly impact financial viability.

For leaders willing to embrace this change, the competitive future offers unprecedented opportunities to reshape healthcare delivery around models that simultaneously improve clinical outcomes, enhance patient experiences, and create sustainable economics. The organizations that thrive won’t be those with the longest history or largest facilities, but those that most effectively adapt to healthcare’s new competitive reality.

Interested in seeing how Neteera’s technology can help you take advantage of the VBC model? Schedule a demo today.

This article is part of a series on value-based care. If you found this article interesting, you may also like Article 1: Creating Effective Home-Based Care Systems in a Value-Based World